Aliens, Elections, Super Bowl: Nevada Calls Kalshi and Polymarket Unlicensed Sports Betting

Nevada regulators classify prediction markets like Kalshi and Polymarket as unlicensed gambling, issuing cease-and-desist orders and securing court blocks on event-based contracts, especially sports, amid fears of revenue loss to casinos. Federal CFTC support claims preemption over state laws, while Kalshi's Ninth Circuit appeal and Rep. Dina Titus's bill to ban sports contracts highlight the ongoing clash. Bizarre non-sports markets persist, but sports volume drives the conflict.

Nevada’s Ethics Commission: All Bark, No Bite

The Nevada Commission on Ethics advanced complaints against AG Aaron Ford in February 2026 over $35,000+ in luxury travel and alleged misuse of resources, with the case now before the full commission for possible fines. Critics call it a "toothless watchdog" that issues only modest "wrist-slap" penalties—like small fines and training for repeat offenders including Reno Councilmember Devon Reese, ex-Gov. Steve Sisolak, and former Sen. Michael Roberson—failing to deter misconduct or halt careers, while defenders emphasize its role in promoting compliance through training and reputation. Calls are rising for reforms such as higher fines and greater authority.

Vacant Homes Down 20%+ From 2008 Peak — Nevada’s Outlook

Nationwide vacant homes have fallen sharply to 15.1 million (10% vacancy rate), the lowest in 25+ years, signaling a strong housing recovery. Many vacancies are seasonal or vacation properties, with Maine, Vermont, and Alaska leading due to tourism. Nevada has a below-average 9.5% vacancy rate (~124,000 units), often tied to resort/second homes, but still faces high prices and a 61% homeownership rate below the national average.

Nevada's DACA Community Remains Steady Amid National Decline in Active Recipients

Approximately 525,210 active DACA recipients currently live across the U.S., with the majority (about 81%) born in Mexico and California hosting the largest share at roughly 147,440. Nevada has 10,290 active recipients—ranking 12th nationally—and offers supportive policies like in-state tuition eligibility for qualifying DACA students through laws passed in 2021 and 2023. The program's future remains uncertain amid ongoing legal challenges.

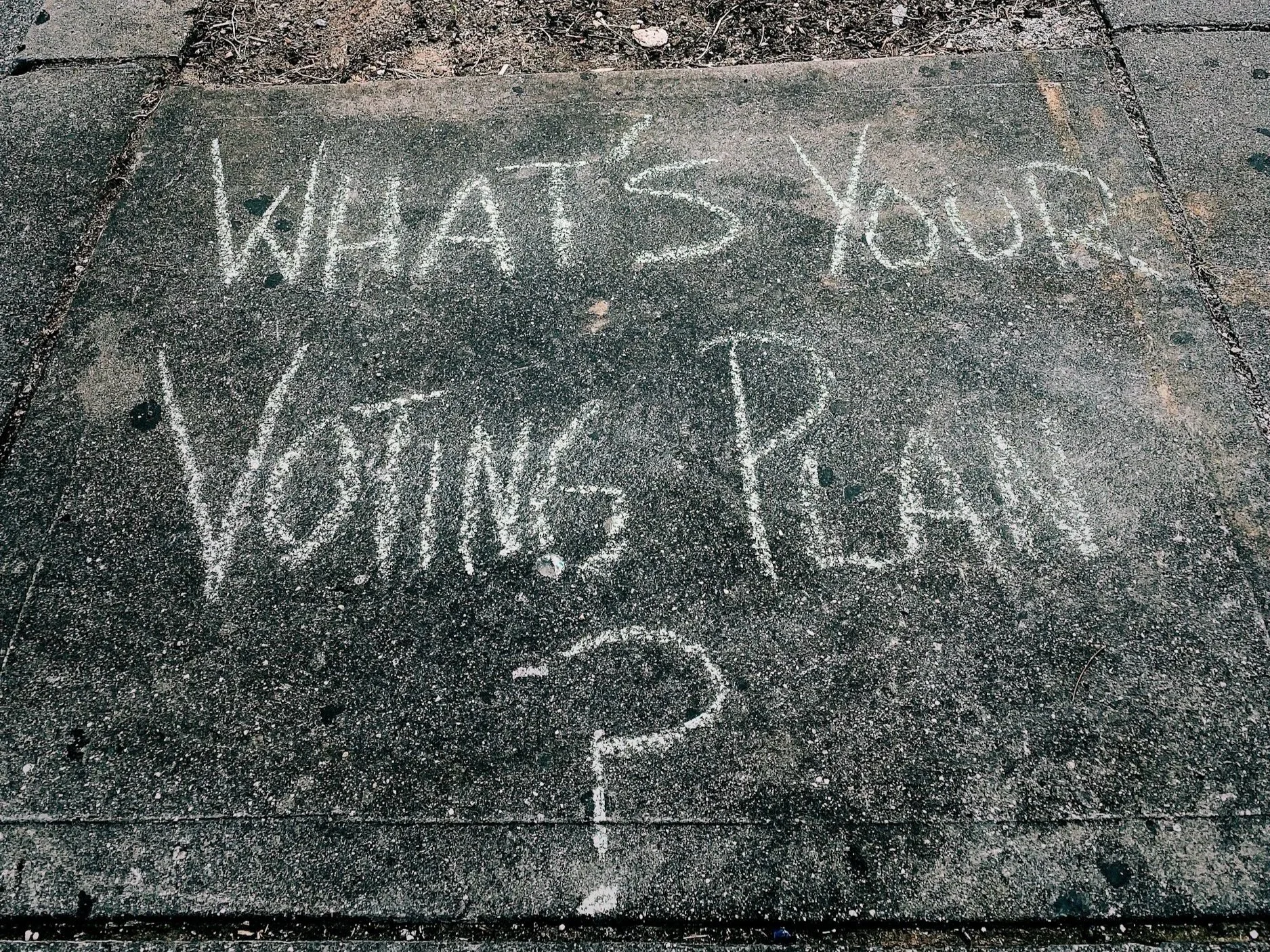

Existing Nevada Voters Unaffected by SAVE Act; New Registrations Require Proof of Citizenship Instead of Current Requirement of Sworn Affidavit

The SAVE Act would require Nevadans to show documentary proof of citizenship—such as a passport or birth certificate with photo ID—when registering to vote in federal elections, ending the current practice of simply signing an affidavit under penalty of perjury. Existing registered voters would remain unaffected and could keep voting without new proof, unless they update their registration (e.g., for a new address or name change). Nevada’s current system of online, mail-in, in-person, and same-day registration would face major new hurdles if the bill becomes law.

U.S. Car Insurance Rates Drop 6%, Nevada Remains Among Most Expensive

Car insurance premiums fell 6% nationally in 2025, bringing the average annual full-coverage cost to $2,144 and providing relief in 39 states after years of increases. Nevada bucked the trend with rates nearly unchanged, rising just $7 to $2,897, ranking it 10th highest due to high urbanization, vehicle theft, and DUI rates. Experts forecast a modest 1% national increase in 2026, pushing the average to about $2,158.

US Median Income Up 32%, But Nevada Trails at 26% Growth

Over the past five decades, U.S. median household income has risen 32%, reaching roughly $78,000 and indicating broad economic progress nationwide. Nevada has lagged with only a 26% increase, ranking 37th among states, due to its heavy reliance on lower-wage tourism, hospitality, and gaming sectors despite rapid population growth and some recent diversification into tech and other industries. Neighboring Western states like Utah (+78%), Colorado (+67%), Arizona (60%), and California (61%) have far outpaced Nevada, highlighting regional disparities tied to education, high-skill job clusters, and economic diversification.

Grocery Costs Surge in 2025: Hawaii Tops List, Southern States Cheapest, Nevada Near Average

Grocery prices rose 6.3% nationwide by July 2025, with Hawaii leading at $157 per week (up 9.6%), followed by Alaska ($152, up 8.8%) and California ($127, up 3.4%), driven by import reliance and logistics. Southern and Midwestern states like Arkansas remain more affordable, about 6% below average, while Nevada stays near the national benchmark at roughly $120 per week despite ongoing food inflation.

Nevada Gets Modest Federal Farm Aid, Focused on Livestock and Disaster Relief

The federal government paid $9.3 billion in farm subsidies last year, mostly to Midwest and Southern corn, soybean, and cotton farmers. Nevada gets far less, averaging about $25 million yearly. The state's 3,400 mostly family farms depend on disaster relief, livestock support, conservation, and subsidized insurance to manage dry conditions, wildfires, and water shortages.

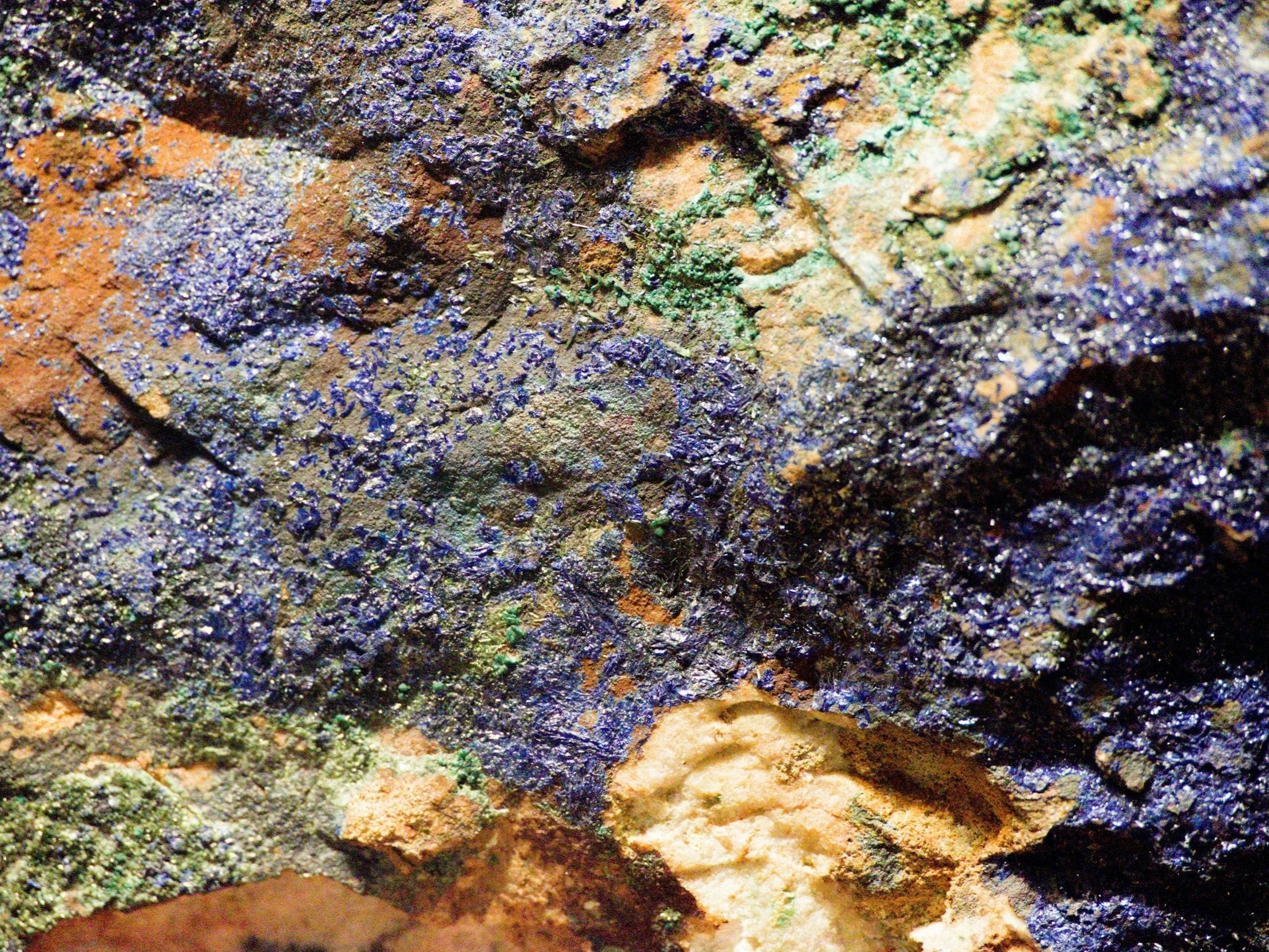

White House Eyes Greenland for Rare Earths While Nevada Holds Untapped Deposits

President Trump targets Greenland and Ukraine for rare earths as China dominates production (69% in 2024) and reserves. Nevada holds significant deposits in the south, with REE potential in lithium projects like Thacker Pass and Bonnie Claire, though no active mining occurs. The nearby Mountain Pass mine in California supplies major global output, and Nevada REE mining could add millions yearly to the state tax base through minerals, property, and sales taxes.

Nevada Young Adults Living at Home 32.7% Above National Average

In Nevada 32.7% of adults aged 18–34 live with their parents slightly above the national average of 32.5% due to severe housing affordability challenges especially in Las Vegas. High-cost states like New Jersey at 44% Connecticut at 41% and California at 39% have the highest rates while affordable states such as North Dakota at 12% and South Dakota at 18% show the lowest. Soaring home prices rents outpacing inflation and average student debt of $35,000 continue delaying financial independence for younger generations.

Nevada Marriages Last Shorter Than Most Due to Young Population and Quick Weddings

Census data shows the national median marriage length is 20 years while Nevada ranks near the bottom at 17.7 years mainly because of its younger population and fame for fast impulsive weddings in Las Vegas. Older Northeastern states like Vermont with 22.6 years see the longest marriages. Nevada's past as the quick divorce capital has evolved into its current role as the top destination for fast ceremonies with age demographics remaining the biggest factor in these differences.

Nevada's Incarceration Rate Falls Below National Average with Fully State-Run Prisons

The U.S. prison population stands at 1.25 million, down 22% from its 2009 peak. Nevada's incarceration rate of 327 per 100K is 9.2% below the national average and down nearly 25% in a decade; all inmates, approximately 10,500, are housed in state-run facilities only. The Department of Corrections budget is about $490 million biennially, averaging $45K per inmate amid staffing and overtime pressures.

Republicans Hold Registration Lead for Over a Year as Democrats Launch Million-Dollar Voter Drive in Response

Republicans have outnumbered Democrats in Nevada voter registration for over a year, the first lead in nearly two decades, while nonpartisans remain the largest group. In response the DNC has launched its biggest ever partisan registration drive, investing millions nationwide including at least $2 million in Nevada to target youth, voters of color, and unregistered Latinos ahead of 2026.

6.5 Million Retirees Coming in 2026: The Most Affordable Cities in Midwest and Nevada

With 6.5 million Americans projected to retire in 2026, demand for affordable retirement destinations remains high. The Midwest, led by cities in Michigan, Ohio, and Indiana, continues to offer the most budget-friendly housing markets, while California cities rank as the least affordable. Nevada provides a compelling mid-tier option with no state income tax, retirement income exemptions, and strong appeal in northern areas like Carson City.

Nevada Rebounds Strongly in U-Haul Rankings, Jumps to No. 20 After Last Year's Plunge

Nevada made a strong recovery in U-Haul's 2025 Growth Index. It climbed 15 spots from 35th to 20th and returned to net-gain status as more people moved in than out. This improvement came from job growth, development in places like Henderson, and steady arrivals from states like California. It marks a clear turnaround from the previous year's big 24-spot drop. Nationally, Texas took back the top spot for net one-way move arrivals. Florida stayed at number 2. Southern states led the list thanks to warm weather, lower costs, and strong economies. These trends continue the post-pandemic pattern of moves toward more affordable areas.

New SNAP Rules Ban Sugary Drinks and Candy

The Supplemental Nutrition Assistance Program (SNAP) now restricts purchases of sugary drinks and candy in some states under the Make America Healthy Again initiative, with tighter eligibility limited mainly to U.S. citizens and certain residents, plus stricter work requirements for able-bodied adults without dependents up to age 64. Federal funding shifts reduce the government's share of administrative costs, increasing Nevada's burden by about $25 million annually, while potential penalties loom for high error rates. These changes, part of the One Big Beautiful Bill Act of 2025, aim to curb estimated $3 billion in annual national fraud; no purchase restrictions apply in Nevada yet.

Enhanced taxpayer-subsidized ACA premiums end; some Nevadans face an average $76 monthly premium increase in 2026.

Taxpayers subsidized health insurance premiums for approximately 110,000 Nevadans through enhanced ACA credits, averaging significant monthly reductions. With those enhanced subsidies expiring December 31, 2025, combined with a 26% gross premium hike, many enrollees now face sharply higher costs—averaging $76 more per month or substantially more for some—in 2026. Base ACA subsidies remain, but affordability is strained for gig workers and self-employed reliant on Nevada Health Link.

19 States Raise Minimum Wages in 2026, Nevada holds at $12

In 2026, 19 states increase minimum wages for over 8.3 million workers, shifting more Americans to $15+ states than the federal $7.25, while Nevada holds steady at $12 per hour—ranking 28th among states above the federal rate after its 2022 voter reform ended the unique two-tier system.

Inflation Keeps Cooling Nationally, Bringing Welcome Relief to Nevada's Economy

U.S. inflation cooled to 2.6% for the year ending November 2025, with everyday items like eggs and hotel stays getting cheaper. Nevada and the West saw a higher 3.0% rate, driven by housing, medical care, and energy costs, but the national slowdown supports Nevada's tourism economy by keeping travel affordable and boosting hospitality jobs.